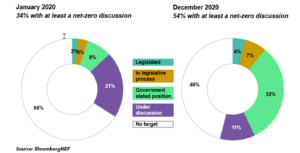

- Sovereigns and sub-sovereigns, public/private sector corporate via policy, legislation or “aspirational” goal-setting sets the stage in 2020 for low-carbon investing with their stated objectives of carbon-neutrality (“net-zero” emissions by a target date) – with over 54% of global emissions now covered under such net-zero initiatives as the BNEF analysis below shows as compared to 34% a year ago, a 50% jump.

- Most have 2050 as targets, some earlier and some later, most are aspirational and not enforceable.

- Investment strategies spanning public and private markets across sectors (forestry and agri, utility, transport, oil and gas) in emerging flavors (VC, alternatives, private and public equity, green bonds, SPACs, infra equity, real asset, ESG) have already begun to mobilize capital flows.

- Net-zero will likely have “zero” emission impact on the scale needed, if capital is not “directed” to geographies where it is needed or in newer technologies and infra (hydrogen, storage, carbon capture, EV) and importantly, towards policies that change our individual and societal attitudes.

- While incremental investments needed over “business as usual” are relatively modest (as % of GDP or in relative or absolute terms) depending on the net-zero pathway by multiple expert group, coordinated actions across sector and geographic boundaries, involving those with net-zero goals is critical.

- Certainty and transparency around these actions (e.g, carbon pricing, coal phaseout) will likely determine the speed of net-zero transitions.