Electrification of the transport sector is one of the major economic transformations we expect to see expect to see in the next 30 years to meet societal net-zero goals.

Internal combustion engine (ICE) based vehicles waste lots of energy – hence are considered “energy inefficient” – i.e., based on energy inputs (oil, diesel) they use to get motive power. Generally, EV’s convert close to 80% of their input energy stored in batteries into drive power, as compared to 15 to 15% to 30% for fossil fuel for ICE-based vehicles. Even after taking the inefficiency of the power systems (generation, transmission and distribution), EV’s come out to be more energy efficient. As battery costs decline, and the EV sector scales up, very soon EV’s will be cheaper in terms of costs than ICE (without subsidies and rebates) – this economic cost parity – driven in part by their being “energy efficient” – will be achieved over the next 5 to 15 depending on a number of market assumptions.

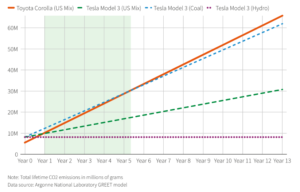

But will EV’s lower our carbon footprints? The answer is not straightforward and more nuanced. Rather, not surprisingly, it depends on how the metal constituents of the battery in EVs are extracted, a process that can be very carbon-intensive, and the nature of grid electricity where the the EV batteries are charged. A well-to-wheel analysis done by Argonne National Labs and Reuters suggests that the carbon parity of EVs vs ICE may be obtained after driving anywhere between the first 8k and 80k miles depending on the grid is hydro- and coal-dominant for an assumed metal battery chemistry.

As governments create incentives and adopt policy measures for “cleaning” up electricity grids and stimulating the EV ecosystem, these findings suggest that rushing into building EV infra, without creating cleaner charging energy or improving battery chemistry, will delay the achievement of our net-zero goals. From an investor perspective, investments that achieve faster net-zero goals may provide a better risk-return.

Here is the Argonne-Reuters analysis: